President Abdel Fattah El Sisi discussed on Monday the state’s banking sector activity with Tarek Amer, Governor of the Central Bank, Gamal Negm, Deputy Governor of the Bank for Banking Stability, Rami Abul Naga, Deputy Governor of the Bank for Monetary Stability, Sherif Hazem, Deputy Governor for the Cybersecurity Sector, Mohamed El-Etrebi, President of Banque Misr, and Hesham Okasha, President of the National Bank of Egypt.

The meeting addressed lands in Egypt’s governorates, which are owned by government banks, the assets of which were discussed in detail. Efforts to develop and achieve optimal use of these assets were also presented, according to Presidency Spokesperson Bassam Rady.

Sisi said that all challenges and obstacles facing these assets be overcome, stressing that the government needs to start preparing urban marketing studies to allow optimal investment for these assets and to serve as an added value to the activities of government banking institutions.

The efforts exerted by the CBE to enhance cybersecurity strategy in the financial sector were tackled, one of the biggest challenges arising amid the country’s transformation into a cashless society. Furthermore, the CBE’s efforts to increase usage of Fintech applications were showcased.

Sisi added that full support should be offered to all pillars of cybersecurity in the financial sector through providing a secure infrastructure and qualified cadres. With that, the insurance system within the banking system will be ready.

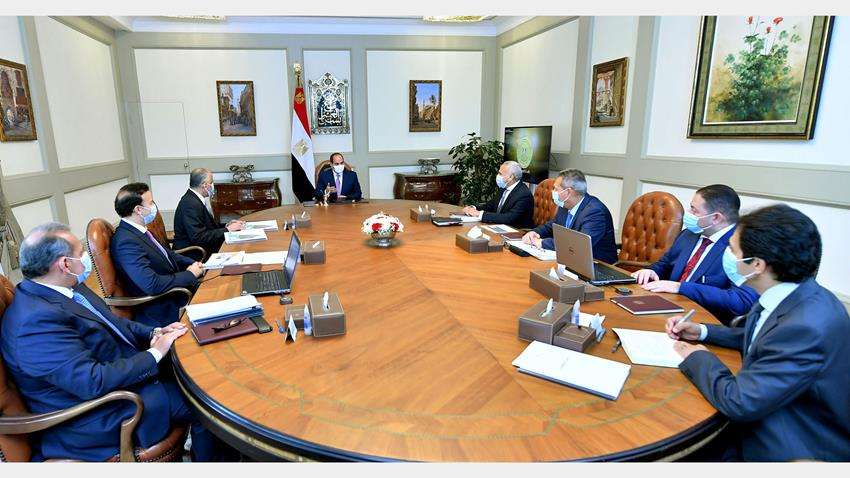

[caption id="attachment_238455" align="aligncenter" width="850"] President Abdel Fattah El Sisi during the meeting[/caption]

President Abdel Fattah El Sisi during the meeting[/caption]

On his part, Amer showcased the development in the banking sector’s performance, banking indicators and financial services provided to the citizens through banks. In this context, he also stressed that the banking sector has a stable performance and was able to overcome the challenges and risks faced amid the COVID-19 pandemic. As a result, it was indicated that the Egyptian banking sector has high capital assets and liquidity.

The presidential development initiatives supported by the Central Bank were discussed in the meeting. The bank provides financing to youth initiatives, middle and low-income groups, and micro, small, and medium enterprises, as well as the private finance initiative. Other sectors, including industry, renewable energy, agriculture, and contracting among other initiatives supporting tourism, hotel development, real estate financing initiatives, and vehicle replacement gain support from the Central Bank.

In this context, Sisi expressed his appreciation for the national banking sector’s effort in the past years. His Excellency added that this sector has contributed to the development path and national projects in Egypt in various sectors, thus enhancing the State’s effort to overcome various challenges.